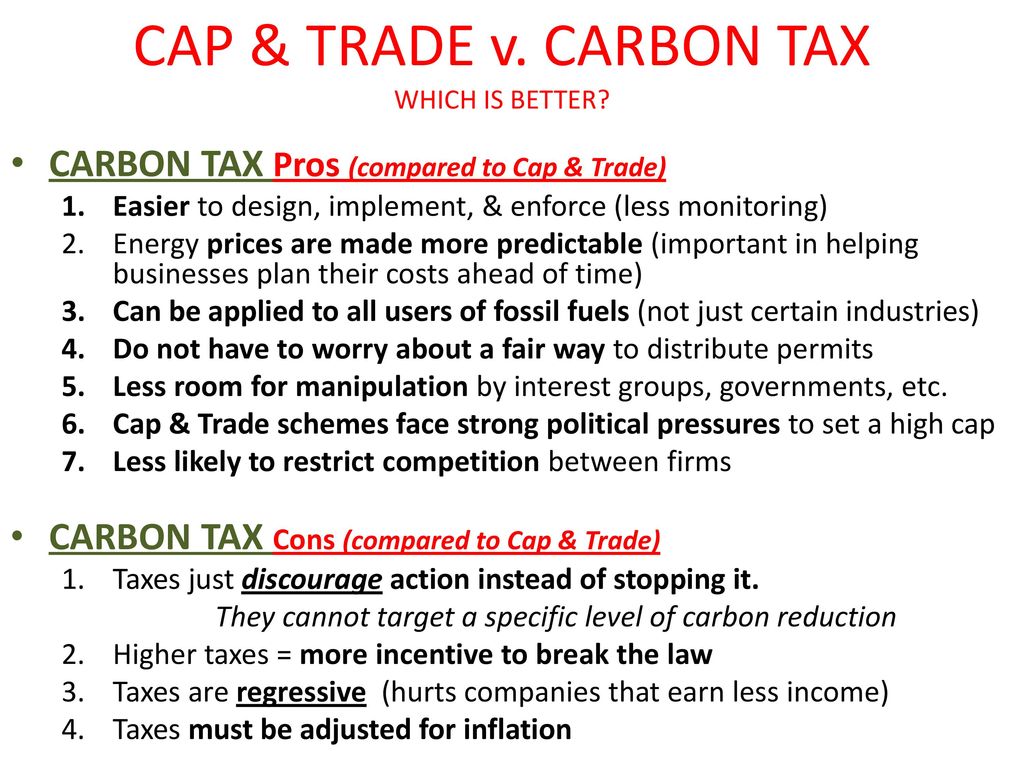

carbon tax vs cap and trade pros and cons

However a cap-and-trade policy offers its own advantages in that emissions allowances can be allocated so as to minimize the policys negative effects on competitiveness and prevent. Both measures are attempts to reduce environmental damage without causing undue economic hardship to the industry.

Ppt Cap And Trade 101 Powerpoint Presentation Free Download Id 676069

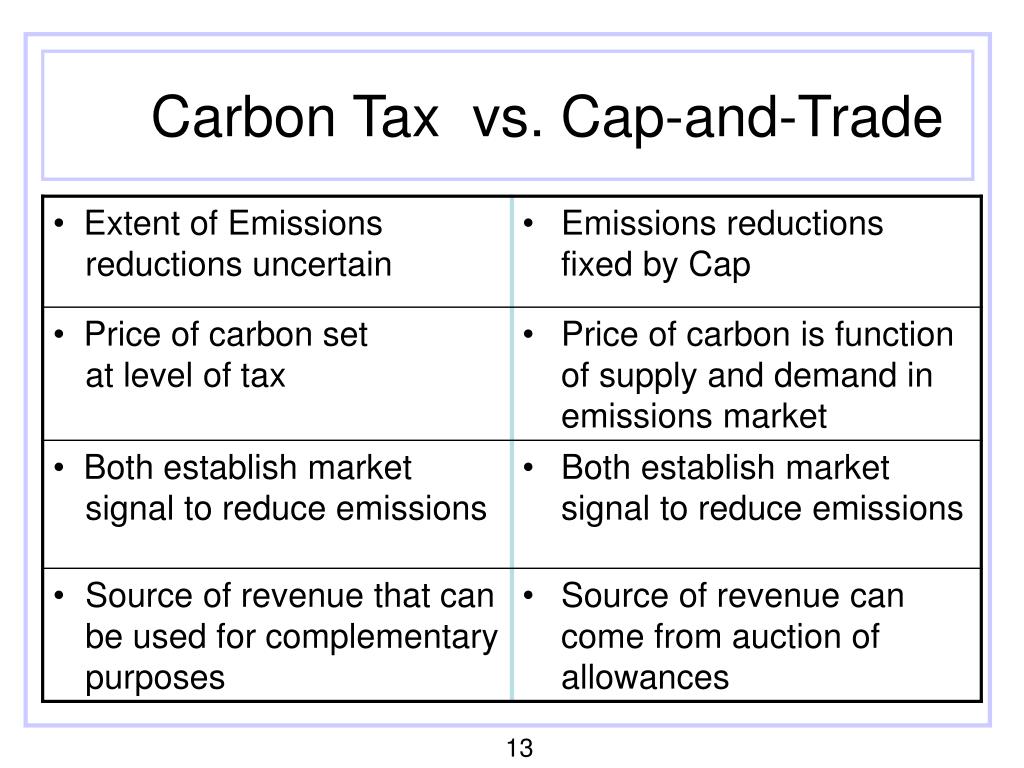

By setting a cap and issuing a corresponding number of allowances a cap-and-trade system achieves a set environmental goal but the cost of reaching that goal is determined by market forces.

. Essentially a carbon tax sets a fixed price for carbon emissions while the ETS sets a fixed quantity of emissions instead. I believe carbon taxes are the better of the two options because it is simple and immediately causes companies and individuals of ways to reduce fuel and energy consumption. Too high and the costs will rise higher than necessary to reduce emissions impacting on profits jobs and end consumers.

A carbon tax imposes a tax on each unit of greenhouse gas emissions and gives firms and households depending on the scope an incentive to reduce pollution whenever doing so would cost less than. This can be implemented either through a carbon tax known as a price instrument or a cap-and-trade scheme a so-called quantity instrument. November 2019 Paper There is widespread agreement among economists and a diverse set of other policy analysts that at least in the long run an economy-wide carbon-pricing system will be an essential element of any national policy that can achieve meaningful reductions of CO2 emissions costeffectively in the United States and many other countries.

Both a carbon tax and a system of cap and trade can be used to achieve the socially efficient level of carbon emissions. However these two methods differ based on a number of factors. In contrast a tax provides certainty about the costs of compliance but the resulting reductions in GHG emissions are not predetermined and would result from market forces.

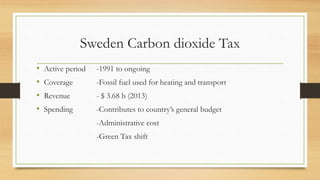

I believe carbon taxes are the better of the two options because it is simple and immediately causes companies and individuals of ways to reduce fuel and energy consumption. Mineral carbon to be taxed beginning in January 2019 at 10 of the rate for other fuels. It compared the expected efficiency gains under uncertainty of a price-based approach as with carbon taxes and a quantity-based approach as with cap and trade.

Taken where we have discussed cap trade vs. In theory those that can easily reduce emissions or increase sequestration most cheaply will do so reducing pollution at the lowest possible cost to the company and society as a whole. By contrast a cap-and-trade system sets a maximum level of pollution a.

Simply put the less fossil fuel used the less the tax affects the company. Carbon Tax - The revenue that a carbon tax generates can be used to encourage investment in more renewable energy projects by offering subsidies to companies who build low or no-carbon plants. 54 International credits were allowed during the first few months of the carbon-taxs operation.

Plus some conservatives may be attracted to a carbon tax as an alternative to more EPA regulations. 0849 1211 MB 192 Kbps. It could start a race for lower emissions technologies which would give energy companies an edge on competitors.

There are two primary methods of pricing carbon-carbon taxes and cap-and-trade programs. I believe both systems have their merits and utilizing either one would positively affect climate change and the economy. The pros and cons of cap and trade suggest that this system is imperfect in some ways.

Any amounts emitted must be offset by a carbon allowance or carbon credit. Beyond helping prevent price volatility and reducing expected policy errors in the face of uncertainties exogenous pricing helps avoid problematic interactions with other climate policies and helps avoid potential wealth transfers to oil-exporting countries. The relative advantage depends on the slopes of the functions that express marginal environmental damages and marginal costs as functions of emissions.

It removes the arbitraging games and artful dodges that have helped undermine cap and trade schemes in places like Europe but in return it requires that politicians vote for a tax. There are additional benefits to be reaped from the implementation of either a carbon tax or CAT system other than just a reduction in emissions. This includes carbon taxes cap-and-trade systems and other forms of pricing.

A carbon tax has a major advantage over cap-and-trade and a hybrid version because it allows for carbon price certainty is less costly to administer and is a substantial source of revenue. The carbon-tax law provided for fossil fuels not subject to existing taxes fuel oil coke and. While prospects for final congressional approval and enactment into law this calendar year still remain far from certain those advocating emissions taxes are facing even more of an uphill battle than colleagues also wanting desperately to do something.

A carbon tax makes it more expensive to emit greenhouse gases which gives people an incentive to reduce their emissions. This system is also one that rewards innovation encourages free market principles and can work quickly to reduce the impact of carbon dioxide and other greenhouse gases on our environment. Clearly a carbon tax is easier to administer.

They are also one of the most effective. The downside is that you need to guess how high to. Economists love discussing the pros and cons of a carbon tax versus the cap-and-trade system.

A price on carbon can also be implemented via cap-and-trade programs which limit the total quantity of emissions per year. The pros and cons of both approaches are. One advantage of a carbon tax would be higher emission reductions than from other policies at the same price.

Both the carbon tax and the ETS reduce emissions by putting a cost on carbon emissions. Both cap-and-trade and a carbon tax need to be enforced emissions must be determined for various sources and penalties imposed if a source does. This video discusses the pros and cons of both the carbon tax and cap and trade.

Proponents of cap and trade argue that it is a palatable alternative to a carbon tax. Carbon taxes would directly establish a price on carbon in dollars per ton of emissions. Cap and Trade vs.

There will always be outliers who try to get away with bending or breaking the rules. The total amount of allowances and credits cannot exceed the cap limiting total emissions to that level. CBO Scopes Out Pros and Cons of a Carbon Tax A federal carbon tax could raise large amounts of money for the government while reducing emissions.

A carbon tax might lead me to insulate my home or refrain from heating under-occupied rooms thus reducing emissions at a lower cost than by using expensive electricity generated from green sources. The revenue could be used to. But only through cap-and-trade and not through taxes.

A carbon tax is a simpler blunter tool which is easier to administer and regulate. Carbon taxes are one of the most popular policy options for reducing greenhouse gas emissions. However they do it in slightly different ways.

A carbon tax could force businesses and citizens to cut back carbon-intensive services and goods.

Carbon Tax Vs Cap And Trade A Comparative Analysis

Carbon Taxes And Cap And Trade State Policy Options Muninet Guide

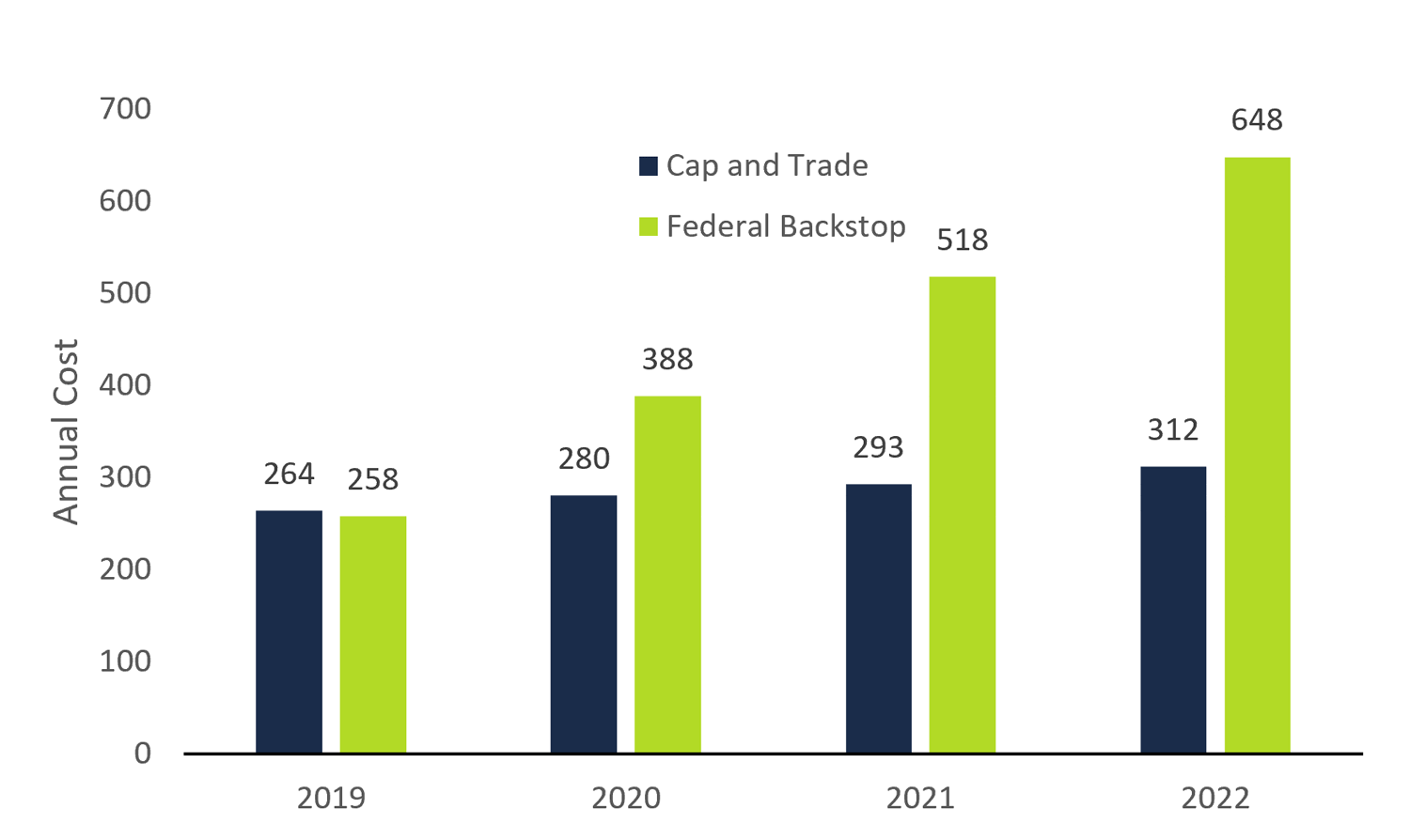

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

Carbon Tax Pros And Cons Economics Help

The Pros And Cons Of Carbon Taxes And Cap And Trade Systems Semantic Scholar

The Pros And Cons Of Carbon Taxes And Cap And Trade Systems Semantic Scholar

Carbon Tax Pros And Cons Economics Help

Market Failure Externalities And Beyond Ppt Download

What Is Cap And Trade What Do Legislative

Difference Between Carbon Tax And Emissions Trading Scheme Difference Between

Economics And Policy At The 49th Parallel Economists Are Like Accountants Except Without The Personality

Difference Between Carbon Tax And Emissions Trading Scheme Difference Between

Seneca Esg Pricing Carbon Emissions Trading Schemes Part 1

Carbon Tax Vs Cap And Trade A Comparative Analysis

27 Main Pros Cons Of Carbon Taxes E C

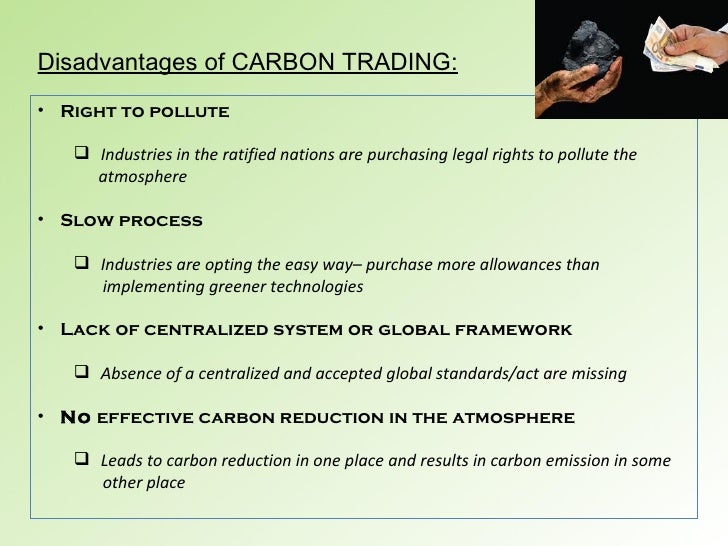

Kezdemenyezes Allatkert Gyarmati Disadvantages Of Cap And Trade Pocztakwiatowa Poznan Com

Carbon Tax Pros And Cons Economics Help